YOU HAVE QUESTIONS, WE HAVE ANSWERS!

VIVA ESCROW Q & A SEGMENT

(Real questions sent to us – verbatim!)

QUESTION:

I am a new Buyer and I can’t find property insurance. Do you have any insurance companies that can help?

ANSWER:

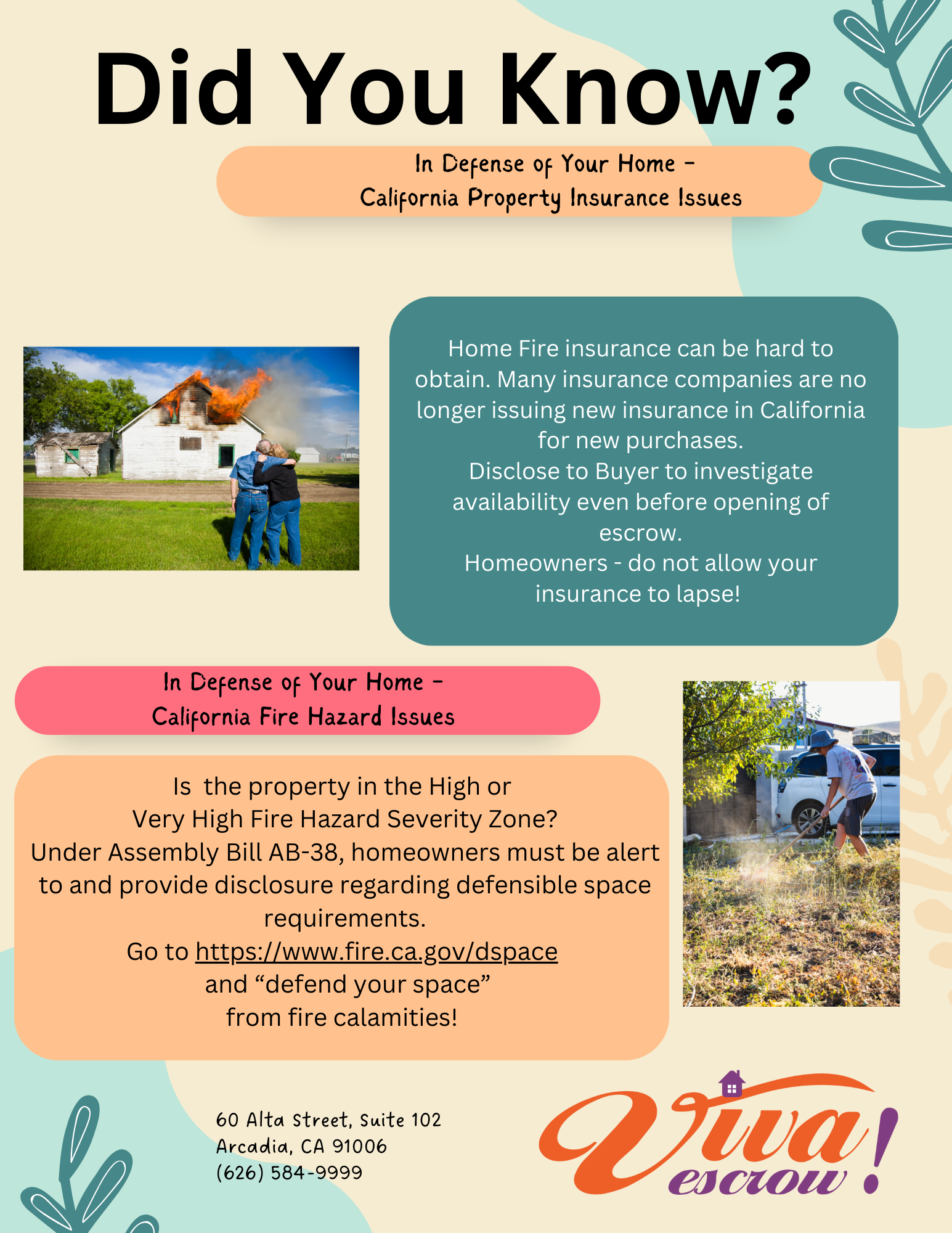

California’s problems with the insurance industry have been going on for a long time, but it only started to affect consumers in the last 3 -4 months, ever since State Farm decided not to issue new residential coverage in the state. Allstate and Farmers Insurance followed. I’m not going into the politics of this, but a simple answer is that due to the wildfire problems throughout the state and the limitations placed on the insurance companies to raise rates to cover their risk, I guess their answer was to pull out of this market.

Is your insurance agent from one of the 3 big insurance companies? My recommendation is that you ask your agent if he has the resources to place from secondary sources. You can also go to insurance brokers who are not tied to any of the big companies and have other lines where they can shop for you…

(I am not going to advertise names and numbers on this blog but if any of you need possible numbers to call, please call your Escrow Officer for their contacts!)

EDUCATIONAL MOMENT:

Not only high mortgage rates, lack of reasonably priced inventory and continuous high prices, the insurance issue is contributing to this period of uncertainty in the real estate industry. The California Association of Realtors (C.A.R.) is cautioning their agents that, like the standard property inspection/ investigations and loan/appraisal contingencies, the ability of property and Buyers to obtain and afford this insurance should also be a contingency. This is what is happening:

- Buyers are finding out close to closing that they can’t obtain insurance.

- Buyers are finding out that their insurance cost would be so high it makes the property unaffordable.

- Insurance companies are not honoring their quotes and rejecting payments after escrow is closed.

- Property owners who forgot to pay their premiums find themselves without coverage and are required to reapply and pay a much higher premium

- Homeowners Associations face the same issues as property owners

- It is not just residential policies; commercial policies are being affected also

Apparently, there are “backroom” negotiations between legislators and the insurance industry which might not pan out if consumer watchdogs keep a sharp eye out. Media reports state that the insurance companies want 3 things (as reported by ABC 7 On Your Side)::

- Rate increases without divulging data;

- Shifting high-risk insurance costs from insurance companies to policyholders

- Charging consumers for what is now considered normal business expenses

Not good! Keep this news in your sight!

**********

~ Video of the Month ~

A public service video – Are you recycling trash correctly?

**********

~ Quote of the Month ~

We judge ourselves by what we feel capable of doing,

while others judge us by what we have already done.

~ Henry Wadsworth Longfellow ~

**********

HELOCS were popular;

why paying it off requires additional IMPORTANT steps by the Escrow officer

**********

You Have Questions? We Have Answers!

Juliana Tu, CSEO, CEO, CBSS, CEI, SASIP

“Escrow is my FOREMOST language!”

Advance Disclosure:

The opinions expressed in this blog are solely the author’s.

Your comments and viewpoints are always welcome.

Info @ VivaEscrow.com